Finding an unexpected lien amount on your SBI bank account can be an unsettling experience. After all, it restricts access to your hard-earned money when you need it the most. Having a lien means you cannot withdraw, transfer, or use a certain amount in your account – it is effectively frozen. This can disrupt your financial plans and ability to pay bills or make purchases when required. Fortunately, with the right approach, removing a lien amount from SBI is possible. This comprehensive guide will act as your roadmap to understand lien amounts and how to successfully get them removed from State Bank of India accounts. We cover everything from lien meaning, reasons for lien, steps to check account lien status, documents required, and time taken to remove lien. Whether the SBI lien is due to missed loan EMIs, IPO applications, technical glitches, or other reasons, you will find a solution here. Read on to empower yourself with knowledge and ensure you can unlock your account by lifting lien amounts restricting your access to your own funds.

A lien amount is a locked or frozen amount in your SBI account that you cannot access for transactions. The bank authorities restrict access to this amount for a period. The entire account balance can be locked as lien amount.

लीन राशि आपके एसबीआई खाते में एक लॉक या फ्रोजन राशि है जिसे आप लेनदेन के लिए एक समय के लिए उपलब्ध नहीं करा सकते। बैंक अधिकारी इस राशि तक पहुंच को प्रतिबंधित करते हैं। पूरा खाता शेष भी संभावित रूप से लीन राशि के रूप में लॉक किया जा सकता है।

SBI has the right to place Lien to protect its interests when terms and conditions are not met.

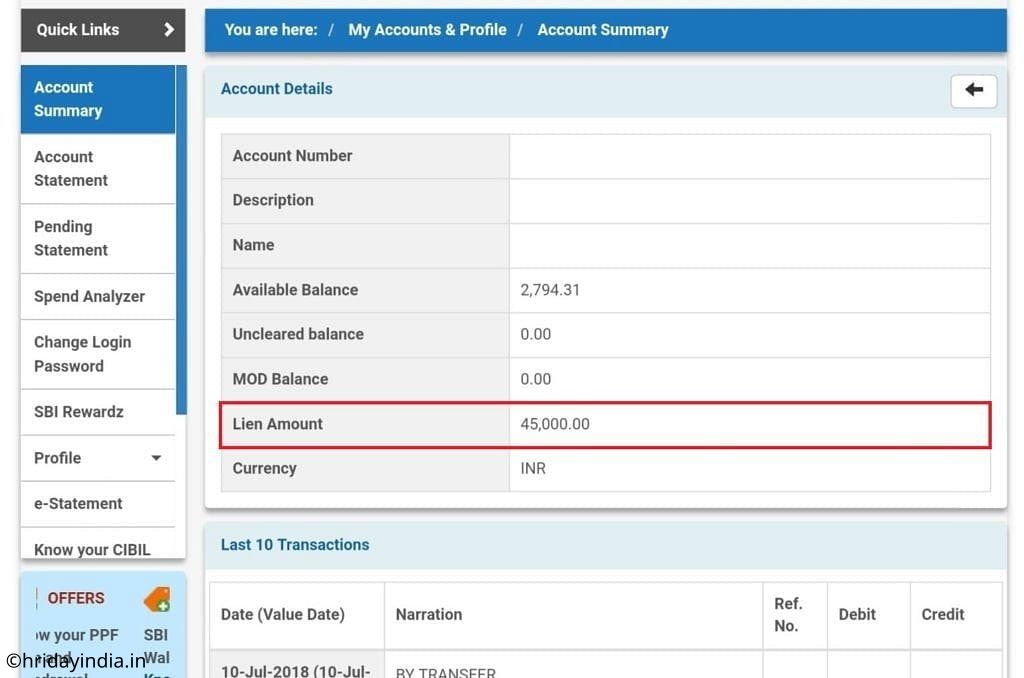

Follow these simple steps to check if your SBI account has a lien amount:

You can also inquire about lien amount by calling SBI customer care or visiting your home branch. The bank staff will be able to confirm if there is any active lien on your account.

SBI, the State Bank of India, provides various types of holds or liens on accounts for different purposes. Here, we present some prevalent liens found in SBI accounts:

1. Overdraft Lien: This particular lien secures an overdraft facility in an account. It allows the account holder to withdraw funds exceeding the available balance, up to the sanctioned overdraft limit.

2. Loan/Credit Lien: SBI may place a lien on an account to safeguard a loan or credit facility taken by the account holder. This ensures that the bank holds a claim on the funds in the account to recover the outstanding loan amount.

3. Fixed Deposit Lien: When a fixed deposit (FD) is linked to a loan or credit facility, SBI may impose a lien on the FD amount to secure loan repayment. The FD cannot be prematurely closed until the loan is fully repaid.

4. Tax Recovery Lien: In cases of tax liabilities or recovery proceedings initiated by the Income Tax Department or other government authorities, SBI may impose a lien on the account to prevent withdrawal or transfer of funds until the tax dues are settled.

5. Guarantee Lien: SBI can impose a lien on an account to provide security or guarantee for third-party transactions, such as letters of credit or bank guarantees.

It’s important to note that the specific liens available and the associated procedures may differ based on account type, purpose, and the terms and conditions set by SBI or other relevant regulations. For detailed information regarding liens on your specific account, we recommend contacting SBI directly.

The process to remove SBI lien amount depends on why it was marked in the first place. Here are the general guidelines:

SBI net banking provides an easy way to raise a request for removing lien amount:

The branch will receive the request and remove the Lien if you have paid relevant dues.

Typically no documents are required from your end to remove SBI lien amount. However, in select cases, the bank may ask for any of these documents as proof:

Visit the branch with required documents to expedite lien removal process.

SBI usually removes the account lien amount within 1-2 working days after your dues are cleared or withdrawal request is processed. In rare cases, it may take up to 7 working days if additional verification is required.

You will get an SMS notification from SBI when the lien amount is finally released and you regain access to the funds. The bank staff can also confirm over phone or net banking if the Lien has been removed.

No, you cannot withdraw the lien-marked amount from an SBI ATM. The ATM will decline any withdrawal attempt from the blocked funds under Lien. You must get the Lien removed first by the bank through branch/net banking. Only after that can you access the formerly locked amount via ATM.

Here are some SBI contacts that can help resolve your lien amount queries and grievances:

Visiting the home branch and meeting the manager is the fastest way to get lien removal assistance for your SBI account.

The lien amount refers to a specific frozen amount in your SBI account that you cannot withdraw or transact with for some time. Due to repayment issues, the bank locks access to those funds as a lien.

You can request a lien removal through SBI net banking under the ‘Requests’ section. Select ‘Remove Lien’ and submit the request. The bank will process it if your dues are cleared.

Clear the outstanding credit card bill payment along with interest to get the Lien removed from your account linked to the credit card.

Submit a withdrawal request to the IPO registrar, who will instruct SBI to remove the lien after canceling your application.

You can only withdraw the lien-marked amount from SBI ATMs when the bank removes the Lien and unblocks your account.

SBI removes Lien from account within 1-2 working days in most cases after repayment of dues. In rare cases where additional verification is needed, it may take up to 7 working days.

Dealing with a lien amount on your SBI savings or current account can be stressful since your access to your own funds is blocked temporarily. Thankfully, by equipping yourself with knowledge of lien removal procedures, you can take appropriate steps to get the problematic lien eliminated in a few days once any pending dues are cleared. SBI provides multiple suitable channels to request unlocking of lien amounts – including visiting the branch, using net banking grievance portal, calling toll-free customer care, or emailing designated grievance resolution officers. With the right information and persistence, you can successfully remove the SBI account lien amount and regain access to your hard-earned money when you need it.